Variable Rate vs. Fixed Rate Loans

When comparing available financing options for your small business, interest rates are one of the most important factors to consider. But not all interest rates are created equal! Understanding the differences between variable and fixed interest rates can help small business owners choose the best option for their business, and potentially save thousands of dollars in interest expenses.

In this blog post, we will dive into the pros and cons of variable rate and fixed rate loans. Each loan type has its own set of advantages and drawbacks, and understanding the nuances of interest rates can help you make the best choice for your unique situation.

Variable rate small business loans

What is a variable interest rate?

A variable rate is an interest rate on a loan or financial product that can change over time based on fluctuations in an underlying benchmark.

Most commonly, variable rates for small business loans are based on the prime rate, which reflects what banks charge their most creditworthy clients. The prime rate is determined based on rates set by the Federal Reserve, and will move in unison with any rate hikes or cuts by the Fed.

A lender will usually base a variable rate on a difference, or “spread” above the prime rate. For example, the interest rate for a StrongTerm Traditional SBA Loan is typically the prime rate plus 2.75%. If during the course of your loan, the Fed raises rates by 0.25%, your loan’s interest rate would increase by 0.25% the next month. If the Fed cuts interest rates by 0.25%, your loan’s interest rate would then decrease by 0.25% the next month.

Variable interest rates are common with long term business loans such as SBA 7(a) loans, as they allow a lender to lessen their risk over the long term without requiring significant collateral, while the borrower saves money if the Federal Reserve lowers interest rates.

Now let’s dive into the pros and cons of variable interest rates.

Pros of variable interest rates

- Lower initial rates: Variable rate loans typically start with lower interest rates than fixed rate loans. This can translate into lower initial monthly payments, making them an attractive option for businesses with limited cash flow. Because these starting interest rates are usually lower, even in a scenario in which the Federal Reserve keeps interest rates level, you will typically have a lower interest rate over the life of the loan.

- Potential for savings: If market interest rates remain stable or decrease over time, borrowers with variable rate loans can benefit from lower overall interest costs compared to fixed rate loans.

- Flexibility: Variable rate loans often come with more flexible terms, such as adjustable repayment schedules and prepayment options, allowing businesses to tailor the loan to their cash flow patterns.

- Longer Term: By lowering their interest rate risk by using a variable rate, banks are often willing to extend much longer terms to clients. Variable rates are common for 10 year SBA 7(a) loans, but fixed rates are often used with higher interest, shorter-term non-SBA loans.

- Relaxed collateral requirements: When dealing with fixed rates, banks often require the borrowing business or business owner to post real estate or other valuable assets as collateral to protect them against interest rate risk. With a variable rate, this risk is mitigated so banks are more willing to make long term loans without requiring significant collateral.

Cons of variable interest rates

- Interest Rate Risk: The biggest disadvantage of variable rate loans is their susceptibility to interest rate fluctuations. If market rates rise, your loan’s interest rate and monthly payments could increase, potentially putting strain on your finances.

- Uncertainty: Variable rate loans can introduce an element of uncertainty into your financial planning, making it harder to predict future monthly payments and total loan costs. With that said, the change in your payment for a long term variable rate loan can be relatively small. For example, the monthly payment on a $100,000 StrongTerm SBA loan would increase by just than $17 per month if the Fed were to raise rates by 0.25%.

Fixed rate small business loans

What is a fixed interest rate?

A fixed rate is an interest rate on a loan or financial product that is locked at its initial interest rate for the duration of the loan. Compared to variable rates, fixed rates have both advantages and drawbacks.

Pros of fixed interest rates

- Predictable Payments: fixed rate loans offer stability by locking in a consistent interest rate and monthly payment throughout the loan term, making it easier for businesses to budget and plan for expenses.

- Protection from Rate Increases: With a fixed rate loan, you are shielded from potential interest rate hikes, ensuring that your loan costs remain constant even if market rates rise.

- Less Uncertainty: Fixed rate loans are ideal for businesses that value long-term financial stability and want to avoid the uncertainty associated with variable rate loans.

Cons of fixed interest rates

- Higher Initial Rates: Fixed rate loans typically come with higher initial interest rates compared to variable rate loans. This can lead to larger initial monthly payments, which might strain your cash flow.

- Missed Savings Opportunities: If market interest rates decrease after you’ve secured a fixed rate loan, you won’t benefit from the potential interest savings that variable rate borrowers might enjoy.

- Limited Flexibility: Fixed rate loans often have less flexibility when it comes to repayment terms and prepayment options, which could limit your ability to adjust your loan to changing business needs.

- Higher Payments: While fixed rate loans protect against interest rate hikes, banks are often hesitant to extend long term fixed rate loans without significant collateral. Shorter terms and higher like-for-like interest rates mean that your monthly payments may be higher than for a variable rate product. These higher payments can consume a business’s cash flow and present a roadblock to growth.

Choosing the right loan for your business

Deciding between variable rate and fixed rate small business loans depends on your individual circumstances, risk tolerance, and financial objectives. It’s essential to carefully assess your business’s cash flow, growth projections, and potential exposure to interest rate fluctuations before making a decision.

If you prioritize stability and predictability, a fixed rate loan might be the right fit for your business. On the other hand, if you’re comfortable with some level of risk and believe that interest rates are more likely to stay steady or decrease, a variable rate loan could offer potential cost savings.

Looking ahead at the Fed

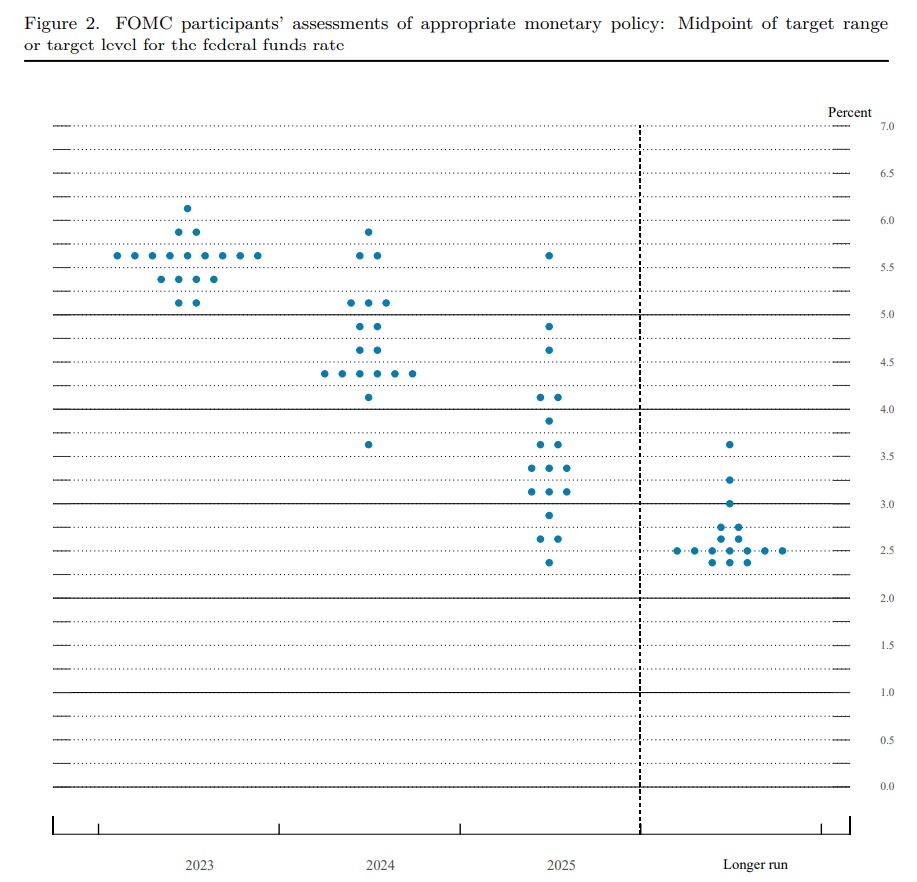

The difference between a fixed rate and variable rate loan is largely dependent on whether the Federal Reserve will raise or lower interest rates over the term of the loan. While even the best economist in the world cannot predict interest rates perfectly, the Federal Reserve publishes the predictions of its members for near future and long-term interest rates.

Currently, all Fed members are anticipating rate cuts in the upcoming years, with a median projection of long-term rates over 3% lower than their current levels.

Federal Reserve dot plot

The “dot plot” pictured below shows the interest rate predictions of the Federal Reserve as of June 2023, and reveals anticipated rate cuts in 2024, 2025, and into the future.

Fixed vs. variable: the verdict

While each business’s unique situation is different, at StrongTerm, we’ve found that the benefits of a variable rate loan usually outweigh the risks for the majority of our clients.

Because fixed rate loans will typically start at a higher rate than comparable variable rate loans, in a normal economic environment you will typically save considerably on interest payments by opting for a long-term loan with a variable rate and government backing, even if the Fed keeps interest rates constant.

For a long term loan, locking in a fixed rate can leave significant savings on the table when interest rates are higher than their historical norm, as you will not benefit from rate cuts as the Fed normalizes rate.

As we are currently in a high-rate environment, the expected savings from opting for variable rate financing could be substantial if rates take the path projected by the Federal Reserve.

Ultimately, the best choice will hinge on your business’s unique financial situation and your comfort level with fluctuating interest rates. Whichever option you choose, make sure to thoroughly research and consult with financial experts to ensure that your decision aligns with your long-term business goals.

At StrongTerm, we work with both variable and fixed rate loan products. If you’d like to learn more about variable vs. fixed interest rates, or get started with your SBA loan application, the StrongTerm team is here to help.

Please leave your information below, and a StrongTerm expert will be in touch to answer your questions and formulate a custom financing plan to help grow your business.

I was extremely pleased to discover this site. I wanted to thank you for your time just for this wonderful read!! I definitely enjoyed every bit of it and i also have you saved as a favorite to look at new stuff on your blog.